Tax season is stressful enough without scammers trying to trick you. In 2025, these scammers are getting smarter and using surprisingly advanced technology to carry out their attacks. But with a bit of knowledge, you can protect yourself and your finances.

Common IRS Scams in 2025

Scammers are employing increasingly sophisticated tactics to deceive taxpayers. Here’s what to watch out for:

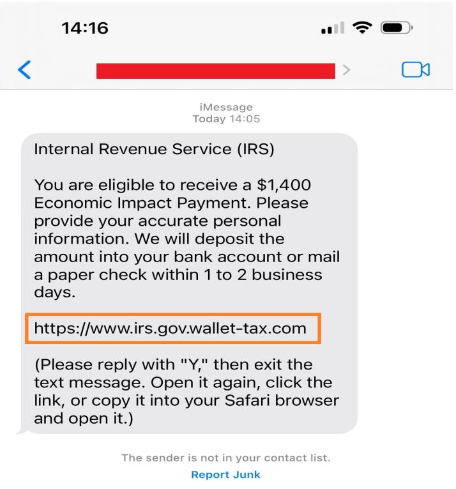

Smishing (SMS Phishing)

Text messages pretending to be the IRS might say something like “You’re eligible for a refund, click here.” That link often leads to a fake website designed to collect your Social Security number and bank info.

Tech Insight: These links often use URL shorteners (like bit.ly) to disguise their true destination, which leads to fraudulent websites. Always be suspicious of shortened links in unexpected texts.

Phishing Emails

You might get an email that looks like it’s from the IRS, with official-looking logos and urgent language. But behind the scenes, these emails are just digital traps. They often contain malicious links or attachments like .pdf or .xls files that can secretly install malware – a type of software designed to steal your data.

Tech Insight: These attachments often contain macros – tiny bits of code that run as soon as you open the file. If your Excel or Word asks you to “Enable Content,” that’s a red flag!

AI-Generated IRS Websites

Thanks to AI, scammers are now building extremely realistic fake IRS websites, some even copy official IRS pages word-for-word.

Tech Insight: These sites may use a trick called typosquatting where they register domains like “irs-gov.com” or “irsrefunds.net”. Always double-check the URL before entering any information.

How These Scams Work (With Simple Examples)

Scammers use psychology and technology to trick people. Let’s break down how some of the most common IRS scams actually work:

Smishing (SMS Phishing)

You get a text message that says:

It feels urgent so you tap the link. Bad move. The following link is not an official link, which is a big red flag.

Phishing Emails

You get an email that says:

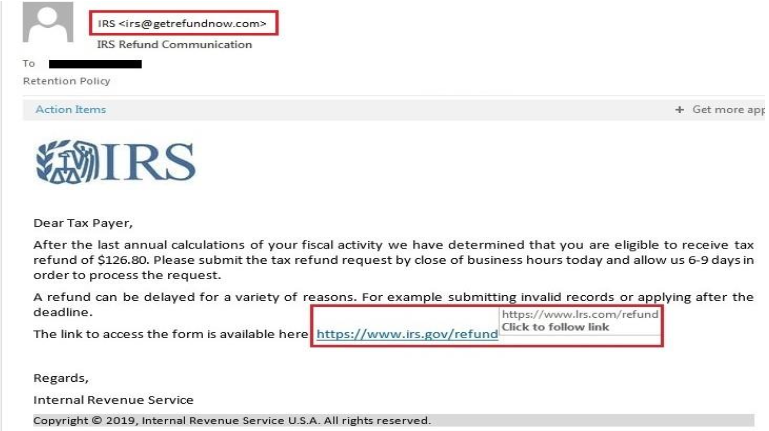

Here as we can see above in phishing email example 1 the red flags that is the sender email id and also the link in the mail which looks like official “https://www.irs.gov/refund” but the actual link embedded to it is “https://www.Irs.com/refund” which is not official IRS link.

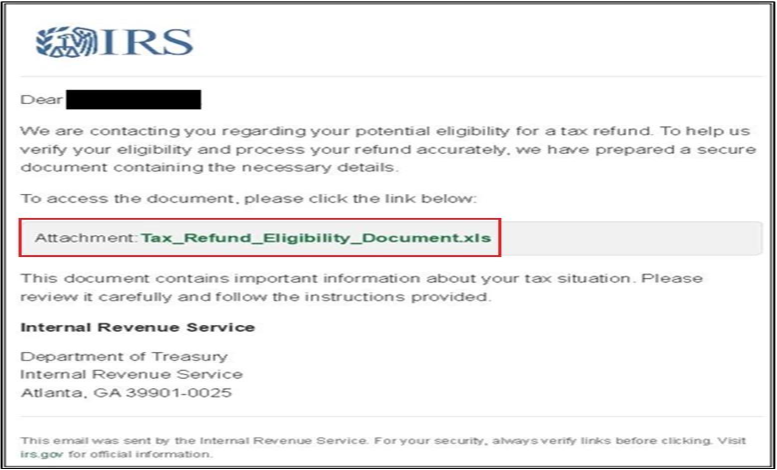

Here as we can see above in phishing email example 2 the red flags are the attachment in the email, which can be Pdf, Document, Excel Sheet and etc. You download the attachment and open it, click “Enable Content,” and unknowingly it installs Spyware/keylogger malware, which records everything you type including passwords or installs ransom malware.

Deepfake Robocalls or AI Phone Bots

You get a call: “This is Agent XYZ from the IRS. You owe $1,450. Pay now, or a warrant will be issued.” The voice sounds incredibly real thanks to AI voice cloning to sound like an IRS agent. You panic and send the money via gift cards or crypto (cryptocurrency).

Remember: The IRS will never call you out of the blue to demand payment or threaten arrest.

Here’s what could happen if you fall for such attack:

The link takes you to a fake IRS page that looks real, asking you to “verify” your Social Security Number or bank account.

Or the site might silently trigger a download, installing spyware or other malware onto your phone/system.

Tech Insight: Phishing sites often use something called a drive-by download, where malware starts downloading the moment the site opens no clicks required.

The IRS 2025 “Dirty Dozen” Tax Scams

Each year, the IRS publishes a list of the top 12 tax scams. These are the worst offenders in 2025:

- Phishing Emails pretending to be IRS alerts or refund notices

- Shady Social Media “Tax Tips” (many of which are totally false)

- Fake Charities soliciting donations

- Ghost Tax Preparers who don’t sign your return

- Offer in Compromise Mills charging huge fees to “settle” your debt

- Spear Phishing aimed at tax pros and accountants

- Bogus Refund Claims using stolen identities

- Fake Unemployment Filings

- Fraudulent Tax Software with malware built-in

- Identity Theft used to file fake returns

- Robocalls from Fake IRS Agents

- Deepfake IRS Videos or Emails (yes, even video scams are a thing now!)

How to Stay Safe – A Few Smart Moves

- Never click on unexpected links or attachments, especially from emails that look official.

- Enable multi-factor authentication (MFA) on your email and tax software accounts.

- Check the web address carefully the IRS will never use .com domains.

- Use verified, credentialed tax preparers, you can search for them on the IRS directory.

- Install an antivirus app that scans for phishing links or unsafe downloads.

- Report scams to the IRS:

- Phishing emails: phishing@irs.gov

- Suspicious tax activity: irs.gov/reportphishing

- IRS Helpline: 1-800-829-1040